Section 179 And Bonus Depreciation 2025 - California Bonus Depreciation 2025 Aubry Candice, 27, 2017, and placed in service during 2025, for 2025 and each succeeding tax year. 2025 Bonus Depreciation For Vehicles Caryn Cthrine, Office furniture, certain vehicles, computers and.

California Bonus Depreciation 2025 Aubry Candice, 27, 2017, and placed in service during 2025, for 2025 and each succeeding tax year.

Section 179 And Bonus Depreciation 2025. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first year depreciation deduction is allowed if the taxpayer begins manufacturing, constructing or producing the property after september 27, 2017, assuming all the oth. Understanding the strategic use of bonus depreciation versus section 179 deduction in 2025 requires a deep dive into the specifics of a business’s asset investments and financial outlook.

Section 179 IRS Tax Deduction Updated for 2025, Your business clients might be able to combine bonus depreciation with a section 179 deduction to maximize the tax benefit of purchases.

2025 Bonus Depreciation Staci Adelind, When considering whether to utilize section 179 deductions instead of bonus depreciation in the year 2025, it’s crucial to understand the potential impact on both cash flow and tax liability.

Section 179 Update, Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest.

Section 179 And Bonus Depreciation 2025 Lenka Imogene, When considering whether to utilize section 179 deductions instead of bonus depreciation in the year 2025, it’s crucial to understand the potential impact on both cash flow and tax liability.

2025 Bonus Depreciation Limit Ilene Adrianne, The house passed the tax relief for american.

Line 14 Depreciation and Section 179 Expense Center for, Understanding the strategic use of bonus depreciation versus section 179 deduction in 2025 requires a deep dive into the specifics of a business’s asset investments and financial outlook.

Section 179 And Bonus Depreciation 2025 Ilene Willyt, Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest.

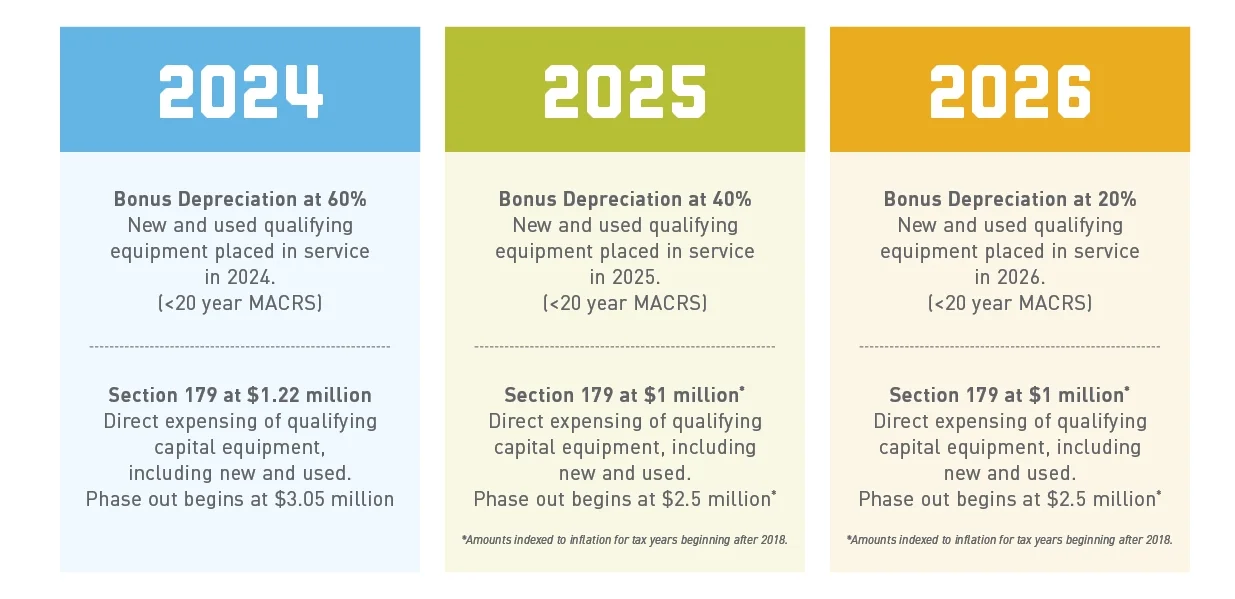

Bonus depreciation, which is generally taken after the section 179 spending cap is reached, will continue to phase down from 80% in 2025 to 60% in 2025. Understanding the strategic use of bonus depreciation versus section 179 deduction in 2025 requires a deep dive into the specifics of a business’s asset investments and financial outlook.

2025 Bonus Depreciation Percentage Table Nelie Xaviera, It begins to be phased out if 2025 qualified asset additions exceed $3.05 million.